Table of Content

The majority of our FL customers live in mobile home parks and/ormanufactured home communities, where the land is leased or rented. We also may be able to provide FL manufactured or mobile home finance if the home sits on a relatives land, and once again is considered personal property. We also may be able to provide Florida manufactured or mobile home finance if the home sits on a relatives land, and once again is considered personal property. MH Loans services the State of Florida to deliver amazing mobile home loan rates and refinancing for manufactured homes.

The HUD regulatory manufacturing standard ensures that American mobile homes are built to last decades if properly maintained. Florida Modular Homes has access to a unique financing program designed for homebuyers who have experienced challenges with their credit. Below we have outlined our basic FL requirements and guidelines to better assist you. Bank Repossessions/HUD Foreclosures– We do not provide financing for foreclosed or repossessed properties that are being purchased from another lender, including HUD.

Florida mobile home financing or manufactured home financing.

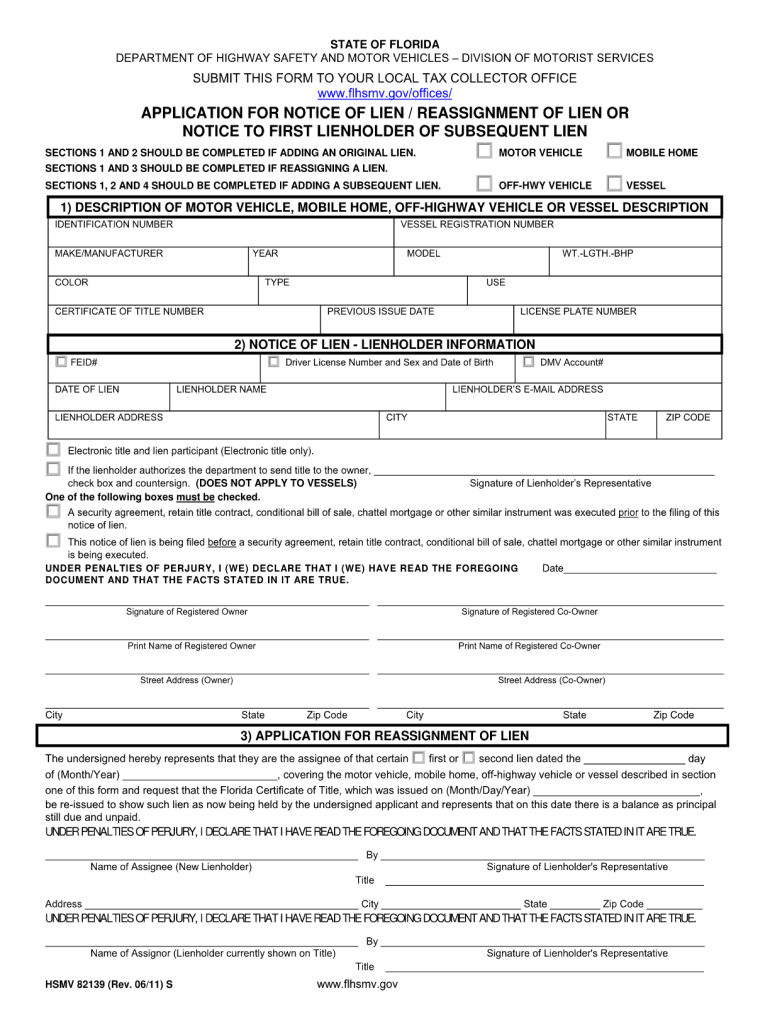

The type of Mobile Home loan received depends of several different factors. The Year of the Mobile Home and Current Value is a strong factor as is the Credit of the Applicant and the Monthly Income. We are also pleased to offer a free mobile purchase agreement along with Florida State Titling Forms.

Priced at $164,900 with VA, Fha and possible seller financing. Automated underwriting approval required for conventional financing. DU must clearly indicated the structure as a Manufactured Home.

Florida Mobile Home

Your down payment can be as low as 3.5% of the purchase price. Florida Modular Homes can also pay for all or most of the buyer’s closing cost as well, which allows our customers to keep more of their money in their pocket. Of all the government insured loans available, FHA is usually the easiest with credit qualifying. JCF Lending Group has no specific foundation requirements in FL. As previously mentioned, the home must be set-up and in move-in condition, to include functioning electrical and plumbing.

If you are in the market to buy a home, now is one of the best times in decades. By clicking SIGN ME UP, you agree to our terms and conditions. 21st Mortgage takes stringent measures to protect your personal information because we know privacy is a concern for all consumers. Once you complete your application it is encrypted for transmission and then kept secure with industry-leading security servers. A. The 'Save & Continue Later' button should be used in the event that you wish to quit and continue the application at a later time.

MOBILE HOME LOANS BY JCF

This could not be accomplished by adding thousands of dollars to your new FL mortgage to pay commissions to a mortgage broker. In some cases we can finance single wide manufactured homes. You must have good credit and the loan amount can’t be too small (approximately $150,000 or more). First thing is first, technically a mobile home is a factory built home that was constructed prior to June 15, 1976. Even so people still today call newer manufactured homes mobile homes. The terms people use can change depending where you live but in Florida people often use the term mobile home for manufactured homes constructed after 1976.

Used Mobile Home FixedLoans must be for primary residence only. New Mobile Home FixedLoans must be for primary residence only. Mobile homes must be constructed from fireproof and fire-resistant materials that give inhabitants enough time to escape in the case of fire. Mobile homes must have a permanent steel chassis affixed to the bottom of them. Every mobile home in the United States is built to a quality standard mandated by federal regulatory law as enforced by the United States Housing and Urban Development. And over 75% of American homeowners who live in a mobile home make less than $50,000 annually.

THREE MAIN GOVERNMENT INSURED HOME LOANS

FL Co-Op parks are not considered real property and they are not considered personal property or Chattel, the correct term. The share gives them ownership of a percentage of the park, including the roads and common areas. The land sitting under a manufactured home in a Co-Op park is not owned by the home owner, but rather all share holders in the park. So, for example, if the park has 300 homes, the ownership of the park is divided up into 300 shares.

As an example, a 10 or 20 Percent Down will offer a Better Rate than 5 Percent Down. Our terms vary from 7 years to 25 years, depending on the program you choose. The bestFlorida manufactured home financing rate can be obtained in most cases at a 15 year term. You can apply for a P2P or personal loan to get a transportable mobile home. However, you may need at least a 5% down payment and pay higher interest rates.

Older model mobile homes needed to have at least 320 square feet of livable space. But now, that space requirement is at least 400 square feet for modern mobile homes. This can make it easier to set your monthly budget, and can also provide peace of mind. With a fixed-rate loan, even if market interest rates go up, your principal and interest payments won’t. For Buyers - We have several financing options available that include, VA, FHA, Conventional and Seller type Financing.

The mobile or manufactured home can be on blocks, iron pier settings, ground set, or on a full foundation with basement. We finance the mobile home, not the land, so we are not concerned about the home being tied to the land by way of foundation. Credit Score Requirements– No minimum credit score required for most states. Equity loan programs are available for applicants scoring less than 575 with a minimum 35% cash, trade, or land equity typically required. JCF Lending Group has no specific foundation requirements in Florida. If you are interested in used mobile home financing, what you don't know could cost you a lot of money.

An appraisal is required if we do not have the value using the above method. Appraisals take into account recent sales from the same community, and surrounding area to determine the market value. Veterans can use their VA entitlement to purchase a manufactured home with no money down! Keep in mind that when purchasing any home that has a well the VA requires both a bacteria water test and a lead water test.

Indian Reservations in Florida are unique as the true ownership of the land is the Tribe, similar to a Co-Op park. In the past, we have made Florida financing loans in reservations with the agreement of the tribal counsel that we could enter the reservation and/or property in the event of default. Under this program, USDA guarantees 100% of the appraised value of the home and land. The program also helps lenders finance land costs, closing costs, site development, installation and setup costs for the home. It also allows lenders to obtain the loan note guarantee up front, creating more flexibility for both the lender and borrower. The majority of our customers live in Florida manufactured home parks or in leased lot communities.

The HUD guidelines of October 20th of 2008 apply to conventional financing along with FHA and VA financing. A cash out refinance is possible up to 65% of the value of the manufactured home and a max term of 20 years for a cash our refinance. For conventional financing we no longer require an engineer to inspect the tie downs or skirting if there are no additions to the home like decking or awnings.

Installed on a permanent foundation built according to FHA guidelines. All persons applying must live in the home with the exception of vacation homes. We also have "Live Help" operators standing by 24/7, helping both existing and new customers get the answers to the questions they may have, all in real time. To apply for a loan or to open a new account, select the Open and Apply option once logged in. So, you want to know about any issue that may decrease its value before applying for the loan.

No comments:

Post a Comment